-

- share

-

subscribe to our mailing listBy subscribing to our mailing list you will be kept in the know of all our projects, activities and resourcesThank you for subscribing to our mailing list.

Tackling Lebanon's Crisis-Driven Tax Inequities

The Lebanese Parliament will vote on the 2024 budget today after the Finance and Budget Committee took the lead in reviewing and amending the cabinet’s draft. The current draft increases projected state revenue, but its tax regime is more regressive than in past budgets. Lower- and middle-income groups bear the greatest tax burden, sparing wealthier segments of society and interest groups from paying their fair share. Moreover, the 2024 budget fails to properly tax economic activities that mushroomed during the crisis and allowed a select few to amass wealth. In this article, we examine three economic activities that were largely left undertaxed: real estate transactions, imports, and debt settlements.

Real Estate Sector: A Missed Opportunity for Revenue

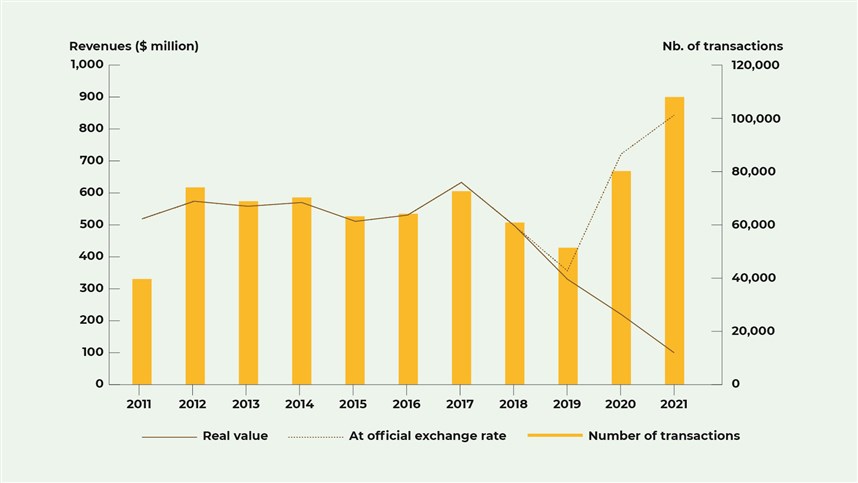

The real estate sector provides a stark illustration of how the devaluation of the Lebanese pound (LBP) affects tax revenues. Despite a surge in real estate transactions, which reached $15.6 billion in 2021, the Lebanese treasury faced staggering losses. Registration fees were collected at the outdated official exchange rate of 1,507.5 LBP/USD until February 2023, resulting in a substantial revenue loss of approximately $1.33 billion by December 2021. The fees per transaction plummeted from about $9,000 pre-crisis to just $720 in 2021, a drastic reduction in state earnings from one of the most active sectors in the economy.Figure 1: Revenue losses from real estate registration fees ($ million)

Luxury Imports: The Cost of an Artificial Rate

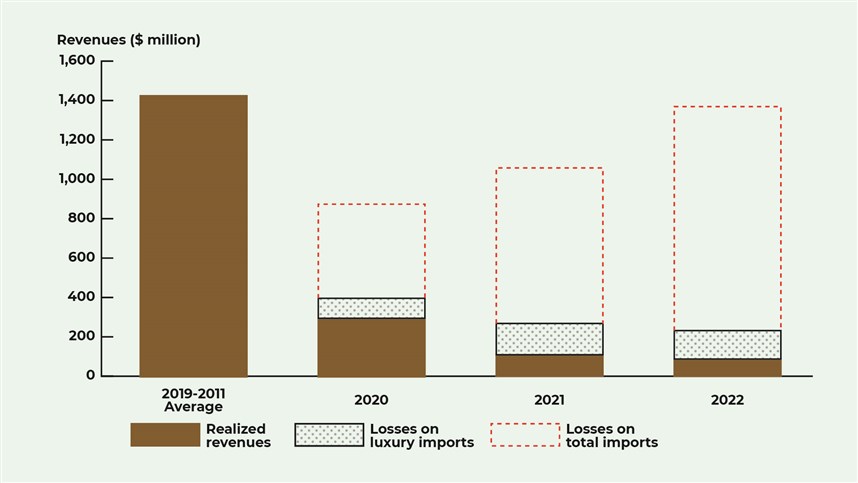

Using the official exchange rate for customs duties through December 2022 essentially subsidized imports. This practice led to revenue losses of about $2.8 billion, including $416 million in duties that could have been applied on luxury goods, such as high-end vehicles and jewelry. These losses highlight a regressive financial policy according to which the state, whether deliberately or not, subsidizes the consumption of the wealthy, eroding much-needed public funds.

Figure 2: Revenue losses from customs receipts ($ million)

Reforming the Tax System

A sustainable and equitable recovery would necessitate measures that not only address causes of future inequality, but also the structural inequalities that have been reinforced by the crisis and caused a major regressive re-allocation of wealth. The current budget does not address any of these urgent measures, and instead compensates for revenue losses through regressive manipulation of the exchange rate. To do so, the following reforms would be critical:

- Vacancy Tax on Property: Implementing a tax on unoccupied buildings to discourage real estate speculation and stabilize housing markets.

- Taxation of Loans and Real Estate Mortgages: Taxing the profits made by individuals who settled their loans at beneficial rates due to currency depreciation.

- Taxation of Undisclosed and Undeclared Revenues: Enforcing taxes on hidden profits and revenues from investments made during the crisis, especially luxury goods and real estate.

- Reform of VAT and Customs Tax: Adjusting VAT and customs tax rates to be more equitable, reducing the burden on end consumers, and correcting imbalances stemming from the use of multiple exchange rates.

These measures aim to establish a fairer tax system, addressing both historical issues and those exacerbated by the recent crisis. The success of these reforms hinges on their thoughtful design, transparent implementation, and the government's commitment to using revenue for social and economic recovery. Establishing a more equitable and efficient tax system will be a critical step in rebuilding Lebanon's economy and restoring public trust.

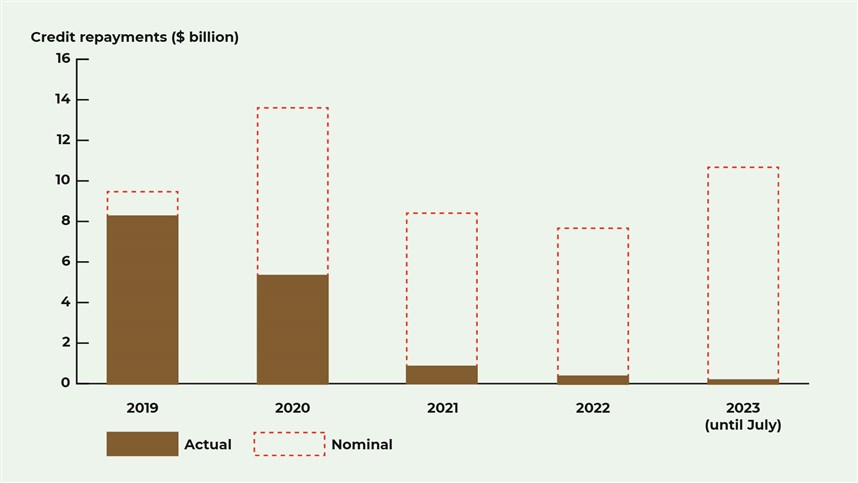

Figure 3: Credit payment, nominal and actual values, August 2019- July 2023, ($ billion)

Debt Settlements: A Windfall for Borrowers

LBP exchange rate disparities created an advantageous situation for borrowers, especially those with loans in foreign currencies. Under Circular 568, real estate loans up to $800,000 could be settled in LBP at the old official rate. This led to borrowers receiving a significant discount on their loans, effectively redistributing wealth from depositors to large borrowers and commercial entities.

The magnitude of these transactions is staggering. Theoretically, at the official exchange rate in place at the time, repayments would have amounted to about $45 billion in real terms. However, since the official exchange rate does not reflect the real value of the local currency on the parallel market, borrowers paid $11 billion. In other words, the discounted amount paid by borrowers since the crisis began totals approximately $34 billion – nearly double the size of Lebanon's current national economy. This is in practice a dramatic redistribution of wealth from depositors to large borrowers and commercial entities, creating market distortions that unfairly benefit credit-dependent companies over those with more robust capital reserves. These profits are considered additional income and should be taxed at a progressive rate; as according to the law, income that is not captured by other taxes is to be taxed at a progressive rate of 4% to 25%. However, due to obstacles related to the current banking secrecy laws, access to information that would allow the collection of these due taxes is not possible.

Related Output

view all-

06.08.22eng

تطويق الأراضي في أعقاب أزمات لبنان المتعددة

منى خشن -

10.12.22eng

فساد في موازنة لبنان

سامي عطا الله, سامي زغيب -

08.24.23

من أجل تحقيق موحد ومركزي في ملف التدقيق الجنائي

اقرأ -

09.09.23

بيان بشأن المادة 26 من مشروع قانون الموازنة العامة :2023

-

08.14.24eng

ما الذي أقرّته الدولة اللبنانية في أيار 2024؟

-

09.03.24eng

ما الذي أقرّته الدولة اللبنانية في حزيران 2024؟

-

09.11.24eng

ما الذي أقرّته الدولة اللبنانية في تموز 2024؟

From the same author

view allMore periodicals

view all-

06.14.24

عطاالله: التدّخل السياسي عقبة أمام تطوّر الإدارة العامة

سامي عطا اللهمقابلة مع مدير مبادرة سياسات الغد الدكتور سامي عطاالله أكد أن "التدخل السياسي هو العقبة الرئيسية أمام تطور الإدارة العامة"، وشدد على أن دور الدولة ووجودها ضروريان جدًا لأن لا وجود للاقتصاد الحر أو اقتصاد السوق من دونها"

اقرأ -

10.27.23eng

تضامناً مع العدالة وحق تقرير المصير للشعب الفلسطيني

-

09.21.23

مشروع موازنة 2023: ضرائب تصيب الفقراء وتعفي الاثرياء

وسيم مكتبي, جورجيا داغر, سامي زغيب, سامي عطا الله -

09.09.23

بيان بشأن المادة 26 من مشروع قانون الموازنة العامة :2023

-

08.24.23

من أجل تحقيق موحد ومركزي في ملف التدقيق الجنائي

اقرأ -

07.27.23

المشكلة وقعت في التعثّر غير المنظّم تعليق دفع سندات اليوروبوندز كان صائباً 100%

-

05.17.23

حشيشة" ماكينزي للنهوض باقتصاد لبنان

-

01.12.23

وينن؟ أين اختفت شعارات المصارف؟

-

10.12.22eng

فساد في موازنة لبنان

سامي عطا الله, سامي زغيب -

06.08.22eng

تطويق الأراضي في أعقاب أزمات لبنان المتعددة

منى خشن -

05.11.22eng

هل للانتخابات في لبنان أهمية؟

كريستيانا باريرا -

05.06.22eng

الانتخابات النيابية: المنافسة تحجب المصالح المشتركة